ATTENTION: First home buyers ready to take the next step

Want To Buy Your First Home And Unsure Where to Start?

Get FREE, No-Obligation, Personalised Guidance from a trusted Mortgage Broker to help you achieve your homeownership dreams.

CLICK BELOW TO WATCH FIRST!

Next Step: (If You Seriously Want to Buy Your First Home)

See How Much You Can Afford By Answering A Few Questions

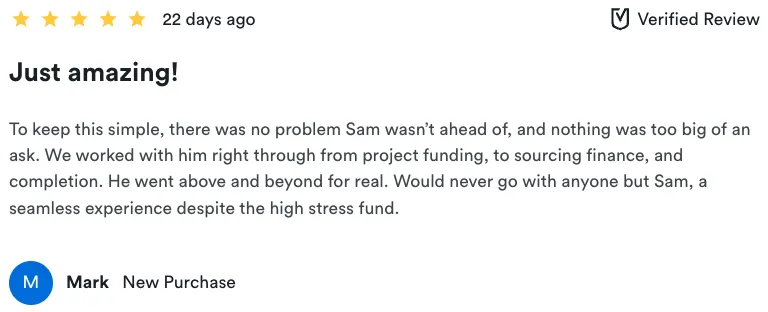

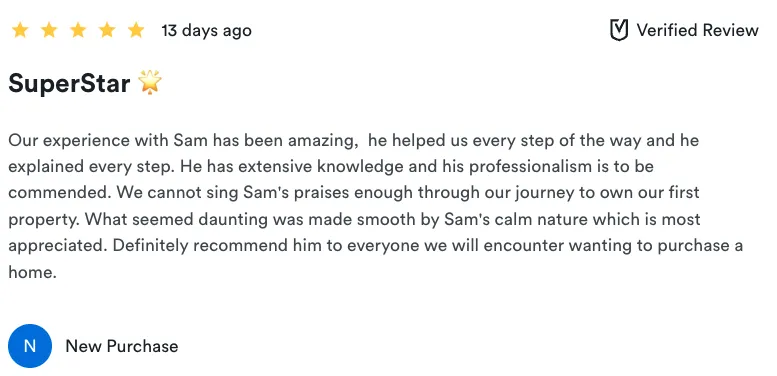

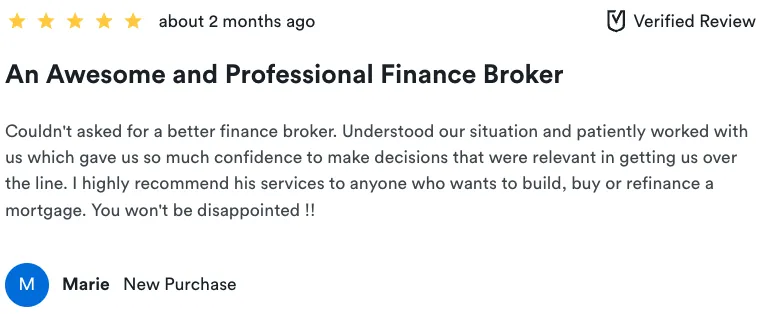

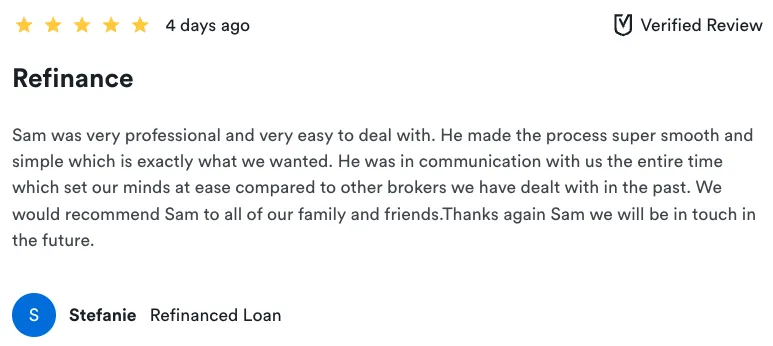

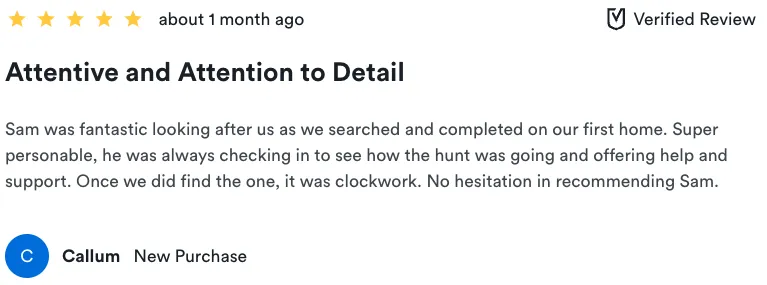

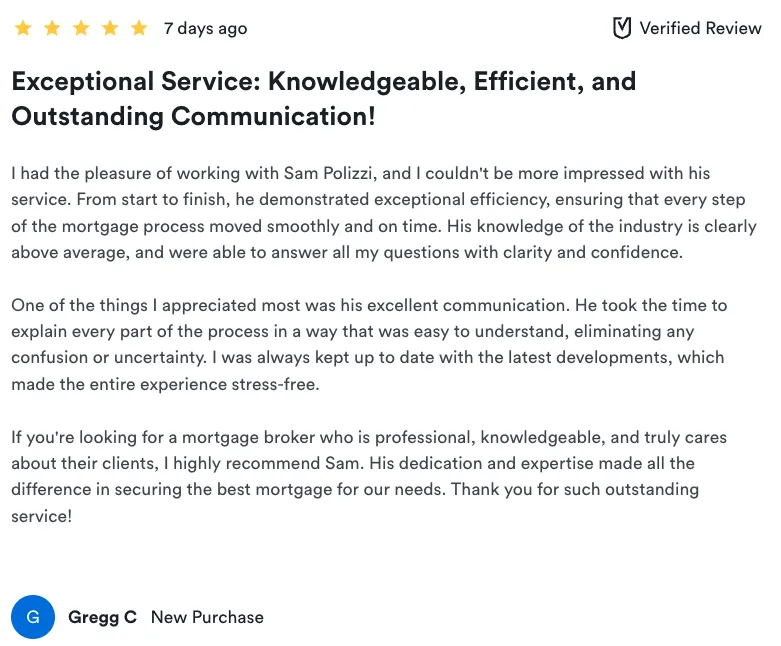

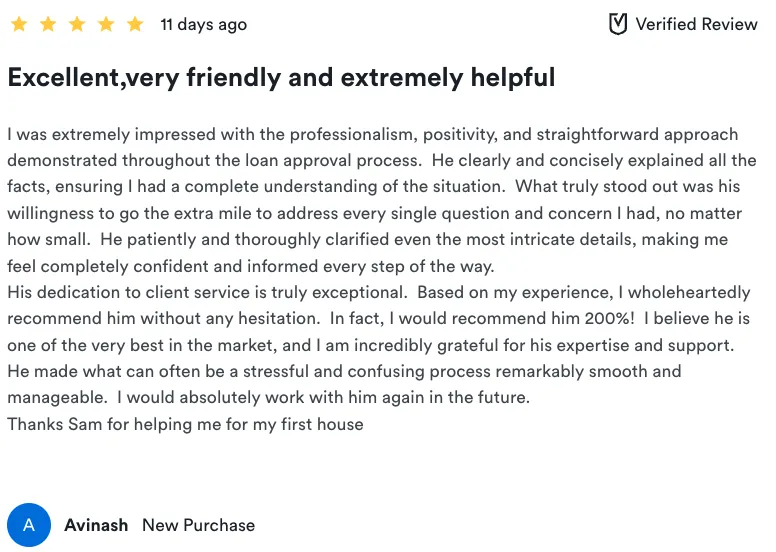

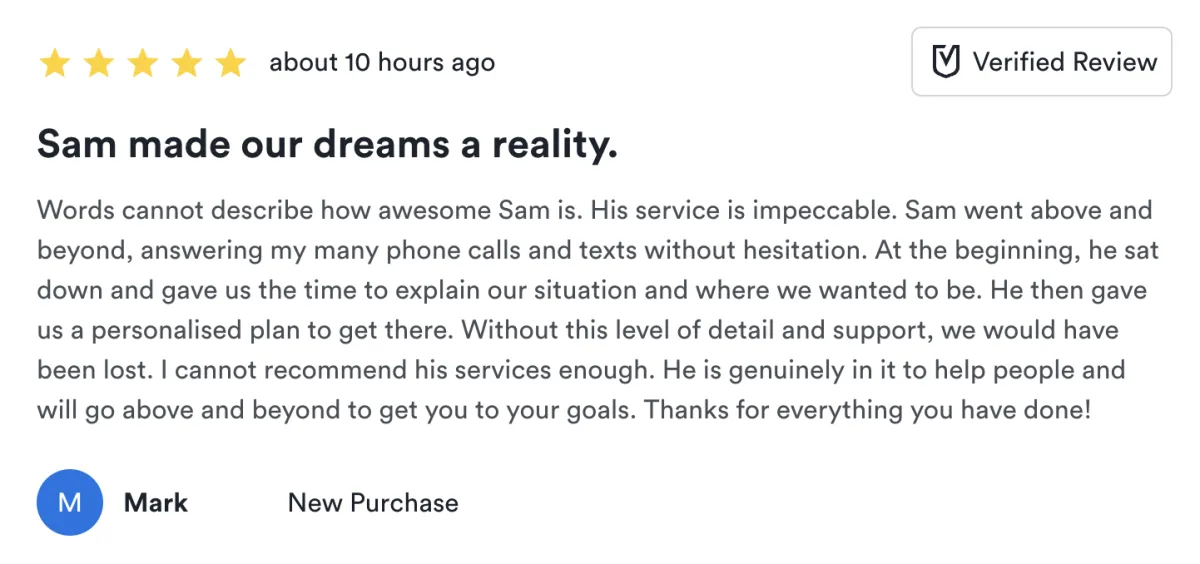

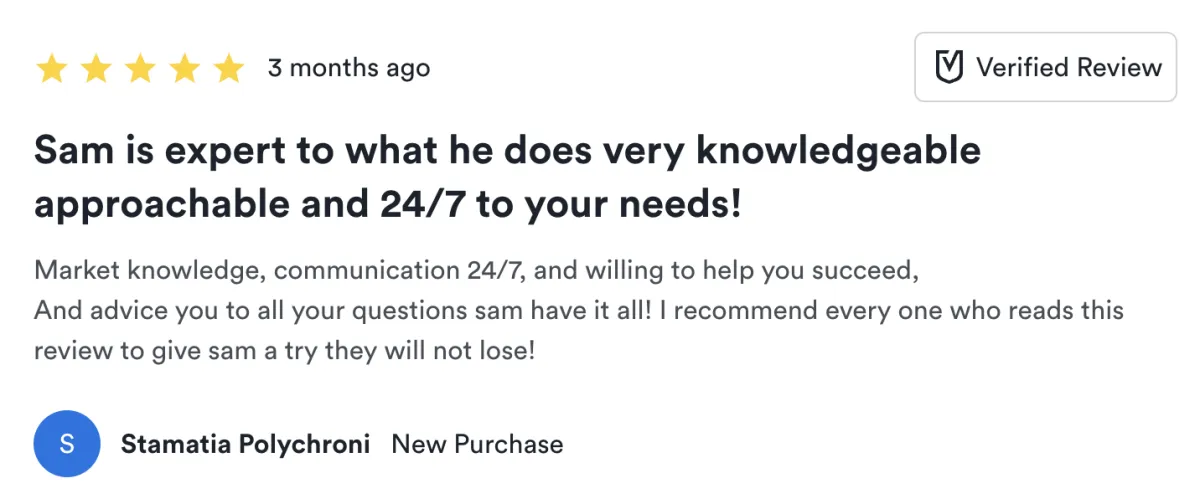

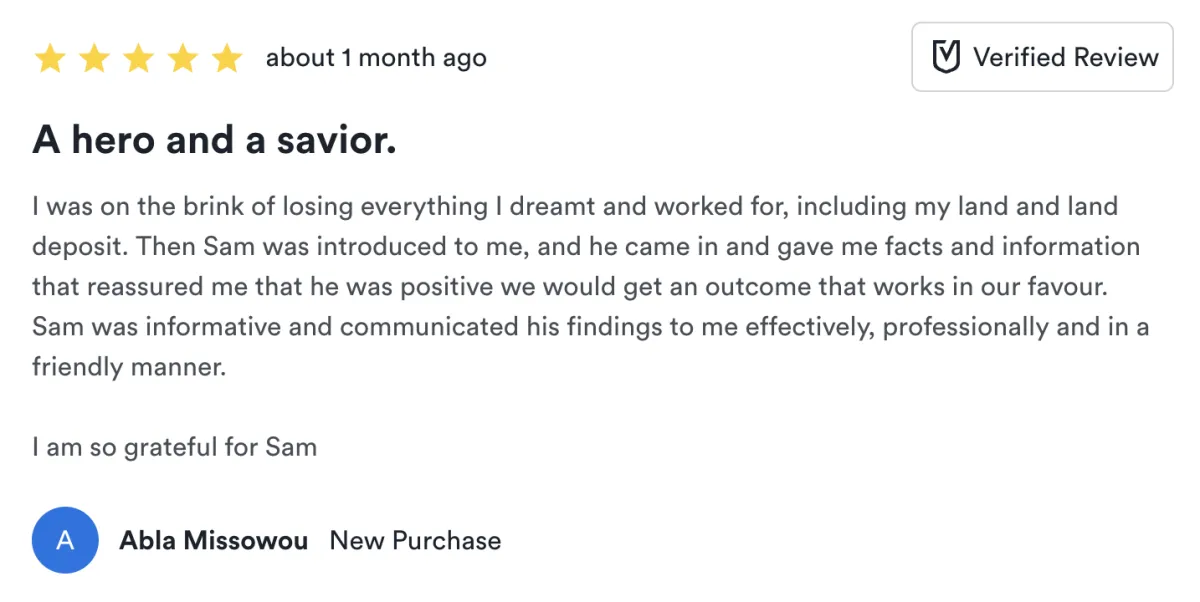

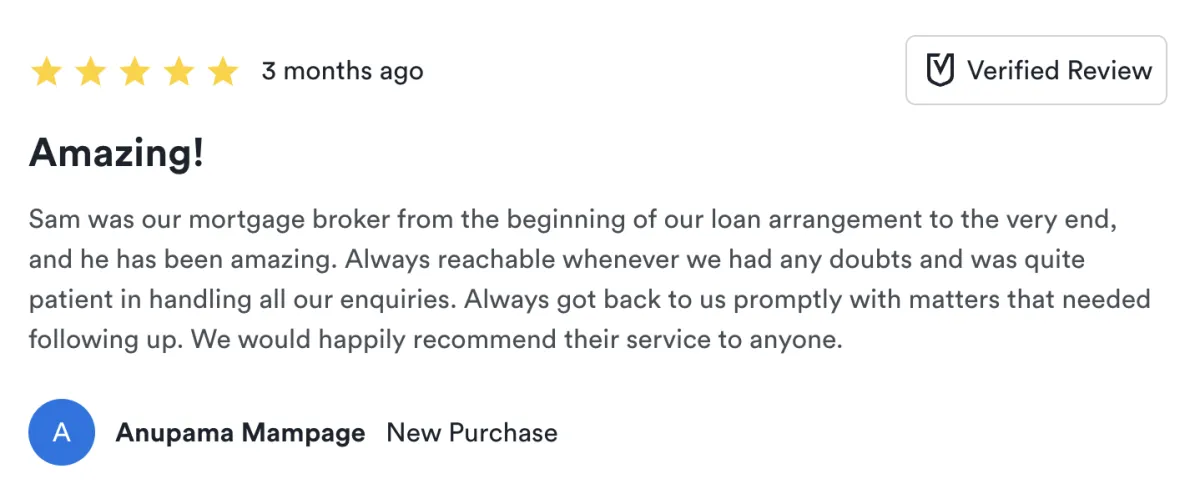

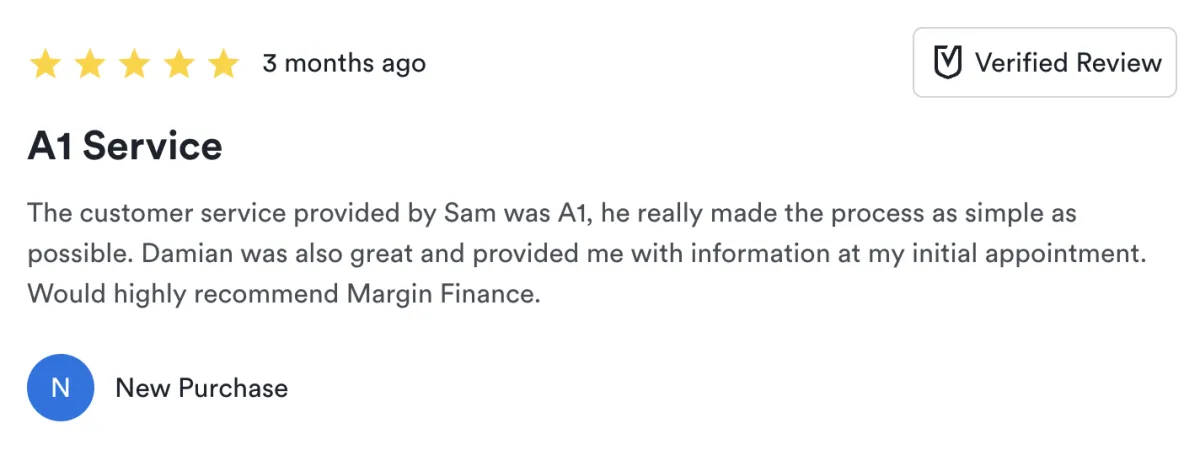

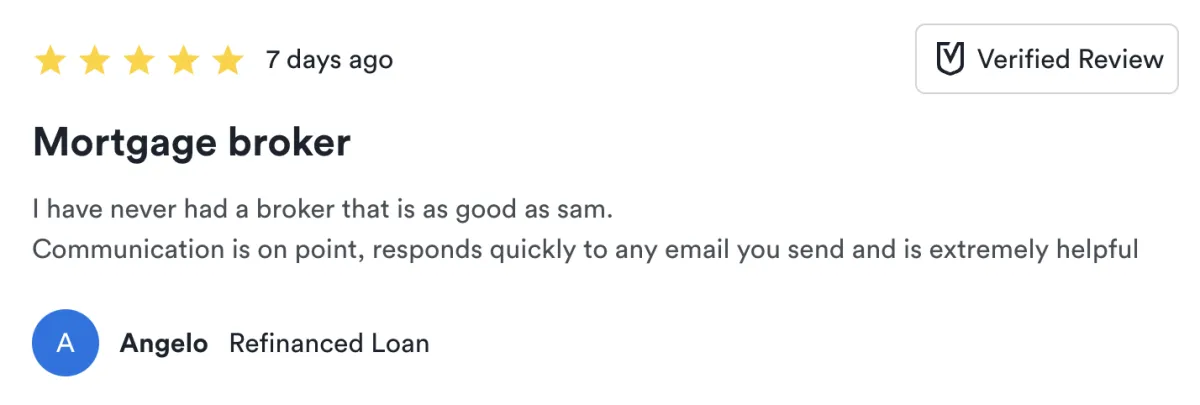

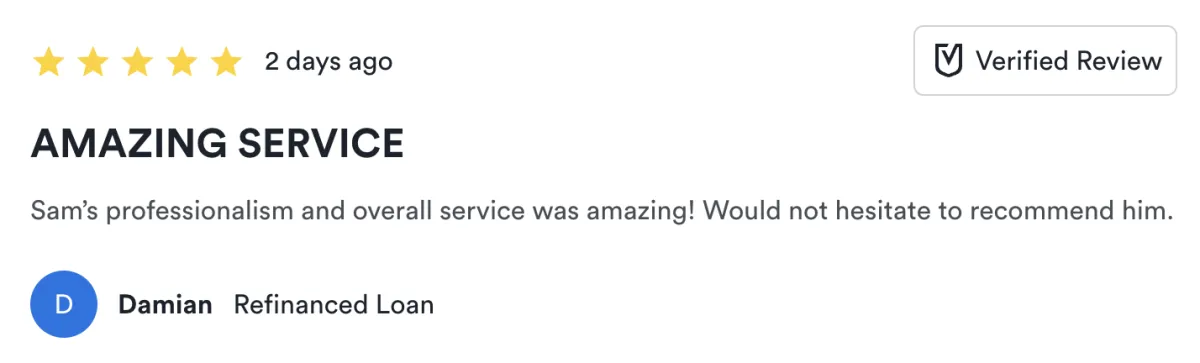

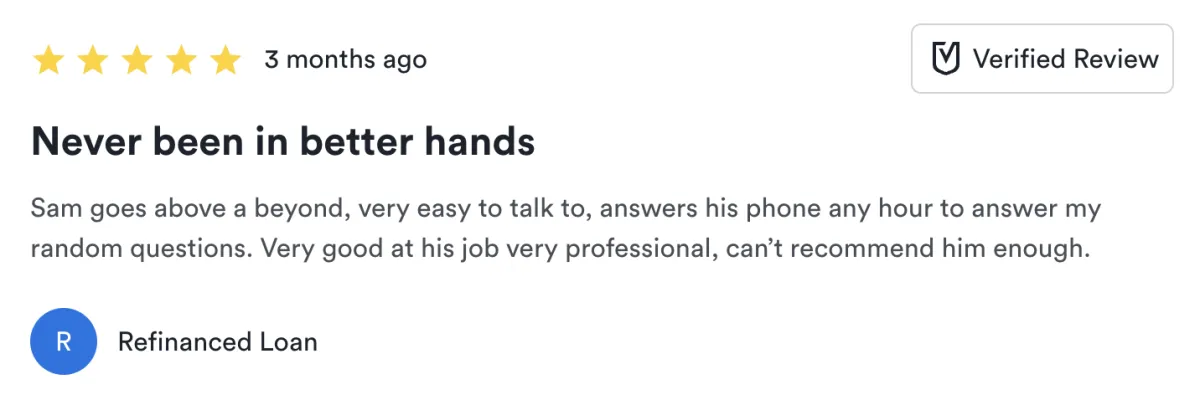

TESTIMONIALS

What others are saying

For Anyone That Wants to Purchase a Property

(With the help, guidance & support of an experienced mortgage broker)

For example...

First Home Buyers

NExt Home Buyers

Investors

wanting to know...

How much you can borrow

how much savings you need

What the hidden costs are

Grants and schemes you're eligible for

If you're eligible for Lmi waivers

Tips to increase your purchasing power

and get...

Tailoered advice

pre-approved

OngOIng support & guidance

for FREE..

STILL NOT SURE?

Frequently Asked Questions

Here's what I usually get asked.

How much does it cost to use your service?

My services are free for you. I get paid by the lender (at no additional cost to you) after your loan settles, so there's no out-of-pocket cost for my advice or assistance throughout the entire process.

What do I need to provide for pre-approval?

I’ll need a few key details, such as your income, expenses, and any existing debts. Don’t worry—I’ll walk you through what’s needed, and you won't have to deal with any paperwork until we're ready to go!

Can I speak directly to a bank?

Yes, you can speak directly to a bank, but they can only offer there own products and wont tell you if another bank can offer you a better deal.

Working with a mortgage broker gives you access to multiple lenders, not just one. I will compare options from a range of lenders to find the best fit for you.

What happens if I don’t qualify for pre-approval right now?

If you’re not quite there yet, don’t worry! I’ll give you a clear action plan on what you can do to improve your chances, and I’ll help keep you on track until you're ready to get approved.

Will I be locked into a particular lender?

No! I work with over 40 different lenders. My goal is to find the best deal for your specific needs. I’ll provide a tailored recommendation, explaining why a particular lender is the best fit for you, and how they compare to other options. Ultimately, you’re in control and free to choose the lender that works best for you.

Can you help me with grants or schemes I might be eligible for?

Absolutely! I’ll make sure we explore all the government grants and schemes you may qualify for to help make your home purchase more affordable. I’ll guide you through the process and ensure you get the maximum benefit.

What’s the catch?

There’s no catch! My goal is to provide you with the best possible advice and solutions for your situation. The consultation is completely free, and you’re under no obligation to move forward unless you’re ready.

How I Help You In

9 Steps

1. Initial Consultation

A casual chat about your goals, answering your questions & providing an overview of your current situation.

2. Verify, Compare & Review

This is about verifying your information, comparing the most suitable lenders for your situation, and completing an in-house preliminary assessment to ensure you meet the banks requirements before submitting an application to give you the highest chance of being approved.

3. Tailored Recommendation

A thorough explanation of which lender is the most suitable for you based on your goals and able to give you the best deal.

This includes a comparison against other lenders.

4. Application Forms

I prepare all of the loan application forms ready for you to review.

This also includes any forms for first home buyer grants and schemes you're eligible for.

5. Pre-Approval

Getting the lender to assess your financial position before purchasing a property so you know exactly what your budget is and can make offers/bid at auctions with more confidence.

6. House Hunting

I'm not a buyer advocate but have access to a lot of property data and statistics.

Which is why I offer free property reports to help you to make informed decisions.

7. Formal Approval

Once you purchase a property and sign a Contract of Sale, I make sure all the final boxes are ticked to satisfy the lenders requirements and get the loan unconditinally approved.

8. Pre-Settlement

to Settlement

Help you review your loan contracts,, reminders to connect utilities, arrange building insurance and complete your pre-settlement inspection.

9. Ongoing Support

Home loan reviews, interest rate reviews, home loan support, answer all your questions, support when the time comes to refinance, restructure your loan for different features or need additional finance.

Ready to get started?

MEET your new mortgage broker

Hey, I'm Sam

A mortgage broker who makes home loans simple.

When passion for property, finance, and helping people combine, you get someone who genuinely cares about getting you into the right home with the right loan.

Whether you're a first home buyer or upgrading, I’ll guide you through the lending process with expert advice and a clear game plan.

No guesswork, no stress—just the right loan for you.